2022 Annual Report

Building on Strength

Business Highlights

Growth and Diversification

2022 was another remarkable year for DUCA, despite a challenging macroeconomic environment. Assets ended the year at $6.9 billion, representing year-over-year growth of more than 25%, and pre-tax earnings netted out at $20 million. Loans, deposits and wealth management all experienced impressive year-over-year growth. DUCA’s total assets under management (which includes wealth management) reached $7.4 billion while membership also grew by 12% to reach 92,340.

DUCA continued to diversify and strengthen our channels of distribution complementing our DUCA- Direct proprietary channels (Branch, Mobile Teams, Member-Connect, Commercial / Business Banking Account Managers and Wealth Management Advisors) with strategic distribution partners and brokerages. The diversification of our distribution channels served us very well again in 2022 supporting our strong, profitable growth result.

DUCA hit several other key milestones in 2022:

- Net total loan growth (new loans originated less pay-downs and discharges) exceeded $1 billion for the first time in DUCA’s history, reaching $1.5 billion.

- Our newly opened Hamilton branch added over 350 Members, $44 million in deposits and $4 million in lending.

- Our subsidiary Continental Currency Exchange (CCE) also reported favourable full year earnings in its first year post-acquisition, due to faster than expected recovery of the travel sector.

DUCA’s growth continues within the context of purpose driven focus to help People, Businesses and Communities Do more, Be more and Achieve more!

Engaging Our Employees

As we build on our strengths as a Credit Union and work to advance our strategic priorities, we’re also committed to investing in our greatest strength: our Employees. As always, we remain anchored by Our Values: Do More – Bring out the best in others; Be more – Do what’s right even when it’s difficult; Achieve More – Make what’s possible happen.

We continue to focus on and enhance our ability to get feedback from our Employees to inform actions toward making DUCA a great place to work. We recognize that a robust feedback cycle involves maintaining multiple touchpoints on a continuous basis. To this end, we’ve rolled out initiatives designed to provide different ways to give Employees a voice, including informal and formal feedback- to-action loops.

Many of the changes and enhancements we’ve made over the past year have been a direct result of Employee feedback:

- Many roles at DUCA have migrated to a hybrid work model. We strive to provide flexibility to work away from the office to Employees in roles that are eligible to work in a hybrid work arrangement. Eligible Employees are now able to work from home and can also take advantage of the facilities at 5255 Yonge Street, where we've begun to welcome more and more people back.

- In 2022, the People & Culture team took a hands-on approach to educating Employees on the available leave and accommodation options available to help Employees take care of the health and wellbeing of themselves and their families. This approach was an outcome of feedback we heard in our previous year’s Diversity & Inclusion survey.

- We continue to find ways to provide support and resources for mental health. We rolled out a paid Wellness Day to help Employees take care of their personal wellness when they need it. DUCA has also enhanced services offered through our Employee Assistance Program to now include longer- duration treatment options for Depression Care and Trauma Care, and added Occupational Therapy to the roster of paramedical services as an additional practitioner for numerous conditions, including mental health.

- We’ve launched the Employee Experience Team, which will play an important role in our efforts to understand what matters most to Employees, and how we can continue to improve DUCA’s Employee experience. Our EET members represent the DUCA community by providing input, feedback, and recommendations on key employee experience priorities.

- We've worked to improve project prioritization and resourcing including clarifying roles, improving understanding of resource allocation and enhancing our capacity to manage change around large- scale initiatives. These efforts are ongoing and are subject to continuous improvement based on Employee feedback.

- We've expanded process and procedure documentation for new and existing initiatives to better support our Member-facing Employees.

- We continue to enhance corporate communications by developing new vehicles such as monthly Employee newsletters, as well launching a new intranet to better facilitate the sharing of information and different employee voices.

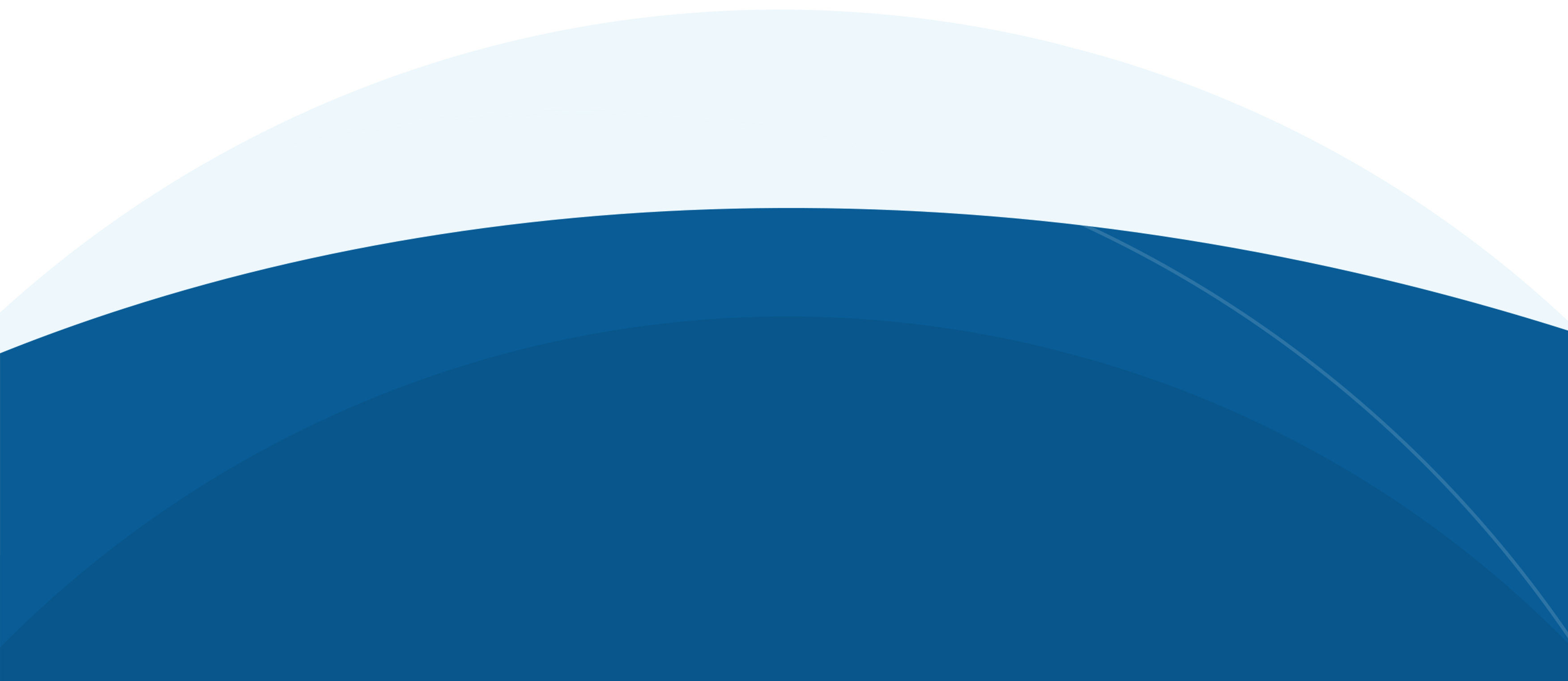

DUCA Impact Lab

The DUCA Impact Lab is a registered charity that focuses on finding solutions for better financial inclusion and equity in the banking system. With a mission to "Build Banking that Benefits All", the DUCA Impact Lab collaborates with our partners in the community and technology sectors to design and test impact lending solutions. We pilot lending solutions primarily to evaluate their social impact and test their viability as financial solutions for those in our community who are not able to access mainstream banking services.

The DUCA Impact Lab is pleased to report that by the end of 2022, we reached $1.3 million of impact lending to date, and made significant investments in our ability to expand and scale our Escalator loan program in the years to come.

DUCA Impact Lab Pilot Example: The Escalator Loan

In 2022, the DUCA Impact Lab focused on building solutions for those in trouble with predatory debt like pay day lending through our Escalator Loan program. The pilot is developing a fairly priced product and advisory service for individuals who have challenges accessing mainstream financial services. The pilot targets individuals with a lower credit score who would typically be ineligible for unsecured lending at a mainstream financial institution. It’s an innovative solution, receiving coverage from media outlets such as Future of Good and has been profiled at leading industry conferences such as the CPA Canada Mastering Money Conference.

It aims to position borrowers for improved access to mainstream financial services through improved credit, enhanced cash flow management skills and increased trust in mainstream lenders. The Escalator loan program provides loans up to $18,000 so that individuals in trouble with predatory debt can break the pay day loan cycle and move forward with their lives.

Over the past year, the Escalator Loan pilot funded a total of $162,455 in personal loans and assisted an additional 22 individuals in getting out of a predatory debt cycle and achieving greater financial stability.

“The Duca Loan

completely changed my

debt repayment and took

SO much stress off of me.

One of my debts had an

interest rate so high that

after a full year I had

barely paid off any! ......It

makes me feel so

encouraged and less

terrified that I was trapped

and actually really helped

me with my self-

esteem... AND I got a small check in the mail based on my interest which was a fun surprise. I would

highly recommend it and think others will benefit from the relief that it brings! Thanks so much!”

-Escalator loan pilot borrower

Social Return on Investment of the Escalator Loan

When we think about return on investment in banking most people think of financial returns. While this is certainly an important measure, it misses the fact that fair, purpose driven lending also creates value for our Members and Communities as well. Improved mental health, stabilized housing, better access to health care and access to quality childcare are all outcomes that can be enabled by the right type of lending but aren’t captured in typical return on investment analysis.

This is why we worked with our Impact Lab partners and Social Value Canada to establish a “Social Return on Investment” Analysis for the Escalator Loan program. Using this framework, for every dollar spent on the Escalator loan program in 2021 there was $11.90 in social value created, a ratio of $11.9 : $1. We are working to evolve this framework to capture an even broader range of non-financial outcomes. This has expanded the collaboration to include Simetrica Jacobs and the Financial Consumer Protection Agency of Canada (FCAC). The result will be an even more complete picture of how the Escalator Loan is Impacting people and communities.

Environmental, Social & Governance (ESG) and DUCA’s Profits with a Purpose

DUCA’s origins as a community driven financial institution are a big part of our history and shapes how we operate today. Throughout our journey, DUCA’s profits have fueled our mighty purpose to help Members, Employees and our Communities Do more, Be more and Achieve more.

Propelling our purpose is the philosophy and belief that cooperative banking can be a powerful force for social good. This means delivering positive environmental and social outcomes and our approach to governance are integrally linked to our mission as a Credit Union and our day-to-day focus on providing financial care to those we serve and sharing our profits.

Going forward, DUCA will continue to build upon its Environmental, Social and Governance (ESG) strengths. In the pursuit of our mighty purpose, we will continue aiming to deliver positive outcomes for community financial health and well-being, diversity, equity and inclusiveness and matters of climate change. In this journey DUCA will continue to:

- Refine our environmental impact goals and measures,

- Build upon our Social Return on Investment (SROI) effort to establish a framework that meaningfully measures our social and environmental impact,

- Scale-up our community impact initiatives and the development of new initiatives including those within our registered charitable foundation – the DUCA Impact Lab.

- Make further progress on Diversity, Equity, and Inclusiveness (DEI) initiatives in consultation with the Canadian Centre for Diversity and Inclusion (CCDI)

- Maintain and build upon our standing as a B Corp.

Our social impact in action

Over the course of 2022, DUCA’s community impact activity was focused on establishing new relationships with organizations such as the Native Canadian Centre of Toronto to assist Indigenous Entrepreneurs in accessing the Centre’s business training and marketplace services. The past year also saw big changes at the DUCA Impact Lab, winding up our successful invoice factoring for small business experiment, and building our capacity to make the Impact Lab’s Social Impact lending programs available to DUCA Members that would benefit. These changes mark a foundational investment in our ability to have an even greater and more focused impact on our Members and Communities. The details of these investments are outlined in the tables below:

B-Corp Certification At DUCA

DUCA’s purpose as a credit union means that as part of what we do, we strive for positive outcomes for our Communities and our environment. This is why we became the world’s first B-Corp certified credit union in 2017 and it means we challenge ourselves to evaluate progress against the B-Corp standards of ESG performance. The B-Corp mission is to transform the global economy to benefit all people, communities and the planet – this is a community DUCA is proud to be a member of.

B-Corp provides us with a rigorous, objective measure of ESG performance across the business – from our community involvement and philanthropy to the environment we create for our employees and Members. Our business practices are reviewed and assessed for added rigor and transparency by B-Lab, the facilitator of the B-Corp certification. It provides us with a clear idea of where we sit relative to the world’s most socially responsible companies and helps inform how we continue to evolve our ESG practices.

Since becoming involved in the B-Corp community, DUCA has been recognized as a “Best for The World” company for our Governance and Workers practices. Our current overall B-Corp score is 102.8, significantly exceeding the standard score of 80 required to become certified. For comparison, the median score for all ordinary businesses attempting the certification is 50.9. To learn more about DUCA’s B-Corp certification our scores are posted publicly by B-Lab on DUCA’s Certified B-Corp profile page.

DUCA Leadership Team

Executive Leadership Team

-

Doug Conick

Doug Conick -

Yan Xu

Yan Xu -

Phil Taylor

Phil Taylor -

Karey Carson

Karey Carson -

Pippa Nutt

Pippa Nutt

-

Riz Ahmad

Riz Ahmad -

Aron Rogers

Aron Rogers -

Michael Creasor

Michael Creasor -

Tom Robertson

Tom Robertson

-

Mo Mauri

Mo Mauri -

Afzal Hussain

Afzal Hussain

Board of Directors

Financial Snapshot

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|

| 1.0 | Key Financial Results and Metrics ($ in thousands) | |||||

| 1.2 | DUCA Net Income | $10,996 | $12,032 | $12,838 | $25,702 | $16,321 |

| 1.3 | ROE1 | 7.2% | 5.8% | 4.1% | 7.4% | 4.4% |

| 1.4 | Efficiency Ratio | 72.1% | 82.7% | 76.5% | 67.9% | 81.8% |

| 1.5 | Leverage Ratio | 5.4% | 7.3% | 7.0% | 6.8% | 6.3% |

| 1.6 | Risk Weighted Ratio | 11.8% | 16.5% | 17.4% | 14.2% | 13.0% |

| 2.0 | Balance Sheet Performance ($ in millions) | |||||

| 2.1 | Assets | $3,374 | $4,056 | $5,112 | $5,522 | $6,936 |

| 2.2 | Loans | $3,007 | $3,507 | $4,129 | $4,848 | $6,411 |

| 2.3 | Deposits | $2,559 | $3,005 | $3,841 | $4,555 | $5,596 |

| 2.4 | Securitization Debt | $630 | $605 | $698 | $468 | $436 |

| 2.5 | Regulatory Capital | $181 | $297 | $360 | $374 | $443 |

| 3.0 | Earnings Performance ($ in thousands) | |||||

| 3.1 | Net Interest Income | $49,745 | $49,026 | $66,789 | $84,294 | $76,949 |

| 3.2 | Fee and other income | $6,988 | $17,350 | $12,282 | $14,412 | $28,143 |

| 3.3 | Provision (Recovery) of Credit Losses | $(320) | $(462) | $1,315 | $37 | $(927) |

| 3.4 | Operating Expenses | $40,930 | $54,902 | $60,466 | $67,012 | $85,974 |

| 3.5 | Pre-tax income before patronage | $16,123 | $11,936 | $17,290 | $31,657 | $20,045 |

1 Computed using income before patronage

Corporate Governance

DUCA operates within the context of a robust legislative and regulatory framework. Our corporate governance policies and practices are consistent with requirements of the Credit Union and Caisse Populaires Act – 2020 (CUCPA-2020, the Act), related authority rules and guidance including (not limited to) the Sound Business and Financial Practices Rule, the Capital Adequacy Rule and Liquidity Adequacy Rule. DUCA is regulated by the Financial Services Regulatory Authority of Ontario (FSRA) which oversees market conduct, administers and enforces authority rules of the Act, regulations and guidance, and provides deposit insurance through the Deposit Insurance Reserve Fund (DIRF) for deposits held at Ontario Credit Unions and Caisse Populaires up to prescribed limits. Within this context, the Board of Directors (the Board) approach to corporate governance is informed by the following guiding principles:

Values & purpose driven

The Board reinforces and champions the Credit Union’s organizational values

acting in a fashion that demonstrates trust, integrity and good governance. The Board’s governance and

oversight ultimately supports the realization of DUCA’s purpose - to help Members and Communities Do

More, Be More and Achieve More. Values and purpose alignment enables the delivery of optimal and

sustainable outcomes for Members, Employees, Communities and Stakeholders.

Stewardship

We act in the best interests of our Members, the Credit Union and our stakeholders. We

do this by following sound business and governance practices in our policy and procedure frameworks

and fostering an environment of integrity. We exercise independent, sound, and unbiased judgement in

our oversight and the constructive challenge, and support of management.

Strategic clarity

The Board ensures DUCA has a clear and focused strategy supported by business

priorities, goals, initiatives, and the financial and human capital resources necessary to successfully

achieve its vision and fulfill its purpose.

Effective oversight

The Board ensures its effective oversight of the risk profile of the Credit Union

relative to its risk appetite, through enterprise risk and compliance management frameworks, policies

and procedures. The Board also reviews and monitors DUCA’s enterprise-wide operational, business,

and strategic risks and compliance status as well as its financial performance. Our oversight ensures

DUCA operates within its risk appetite and in a fashion that results in an appropriate balance of return

for risks.

Improvement mindset

We are committed to continually improving governance and oversight principles,

policies and practices. An improvement mindset helps the Board serve the best interests of Members

and all stakeholders in the context of evolving Member and Community needs as well as dynamic

operational, technological, regulatory, competitive, and economic environments. We enable

improvements through regular evaluations of Board effectiveness, seeking third-party advice, and

ongoing education and training of Directors of the Board.

Audit Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing DUCA’s financial reporting, control environment, and compliance.

The role of the Committee is to oversee and assess the:

(a) Integrity of the financial reporting process and

financial statements;

(b) Adequacy of the internal and external audit

functions;

(c) Adequacy and effectiveness of internal controls;

(d) Adequacy and effectiveness of the risk management

process;

(e) Compliance with legal and regulatory

requirements;

(f) External auditor’s qualifications and

independence;

(g) Performance of the external auditors; and

(h) Performance of the internal audit function.

Credit Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing DUCA’s lending activities.

The role of the Committee is to:

- Provide oversight and advice to the Management Credit Committee and provide recommendations to the Board in relation to current and potential future credit risk exposures and strategy, including credit risk appetite and tolerance.

- Evaluate those loan applications that require review by the Committee in accordance with the Credit Risk Management Policy and approve those loans that it is permitted to approve under the Credit Risk Management Policy.

Nominations Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing the Director nomination and election process. The primary role of the Committee is to source, recruit, and oversee the election of Directors to the Board who meet the qualifications for the role and who will address any competency gaps identified in the Board Competency Matrix (as developed by the Governance Committee).

Governance Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing the quality and effectiveness of DUCA’s corporate governance. The primary role of the Committee is to ensure that the Board of Directors provides for effective governance with respect to board composition, competency and oversight, as well as monitoring current, and evolving governance best practices.

Human Resources and Compensation Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing DUCA’s human resources policies. The role of the Committee is to oversee and assess the compensation of the CEO and members of the Executive Leadership Team and to manage the process of evaluating the CEO.

Risk Committee

Standing committee of the Board to which the Board has delegated responsibility for overseeing the effective operation of all risk taking operations and risk management functions of the Credit Union and ensuring appropriate risk governance processes are executed effectively. The Committee shall review the risk activities of the Credit Union, the associated corporate policies and any significant and emerging events and related action plans and shall recommend any improvements or changes to the Board as deemed necessary or desirable.

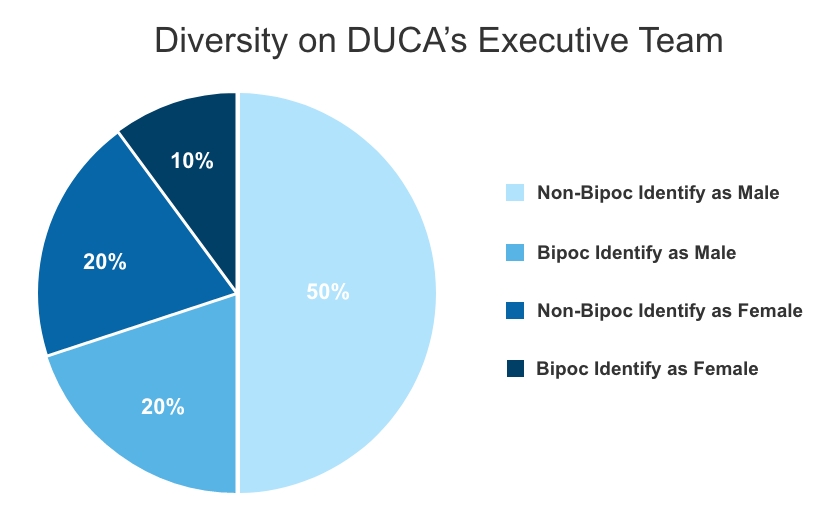

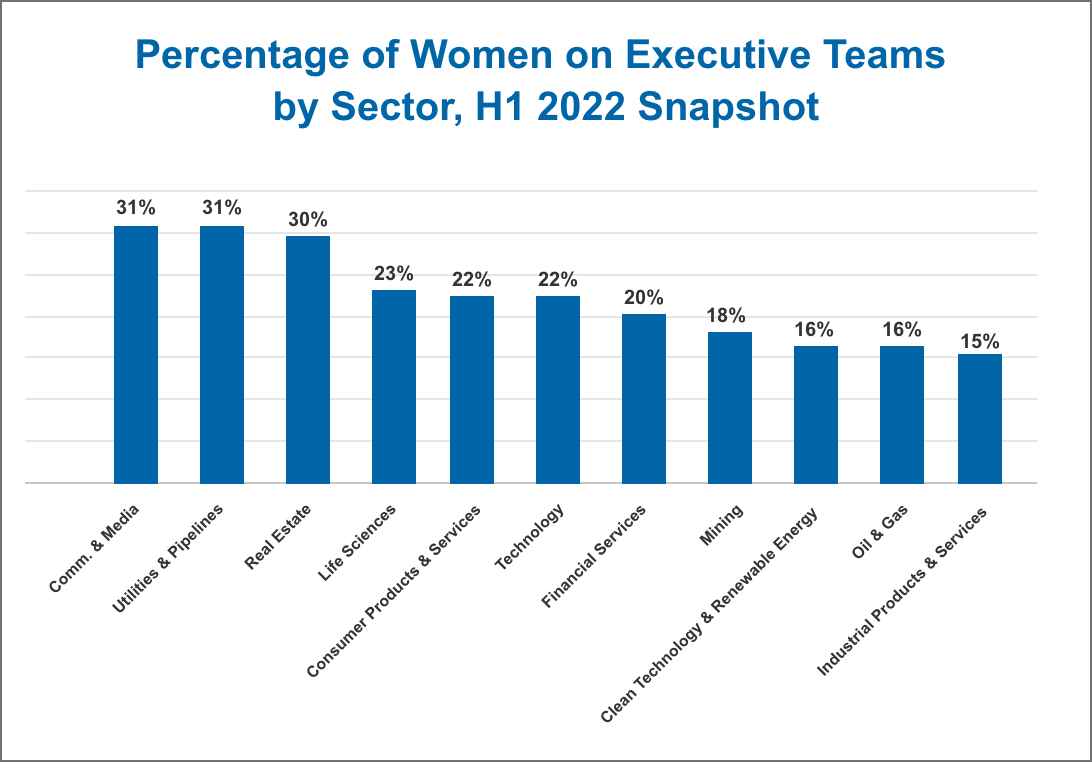

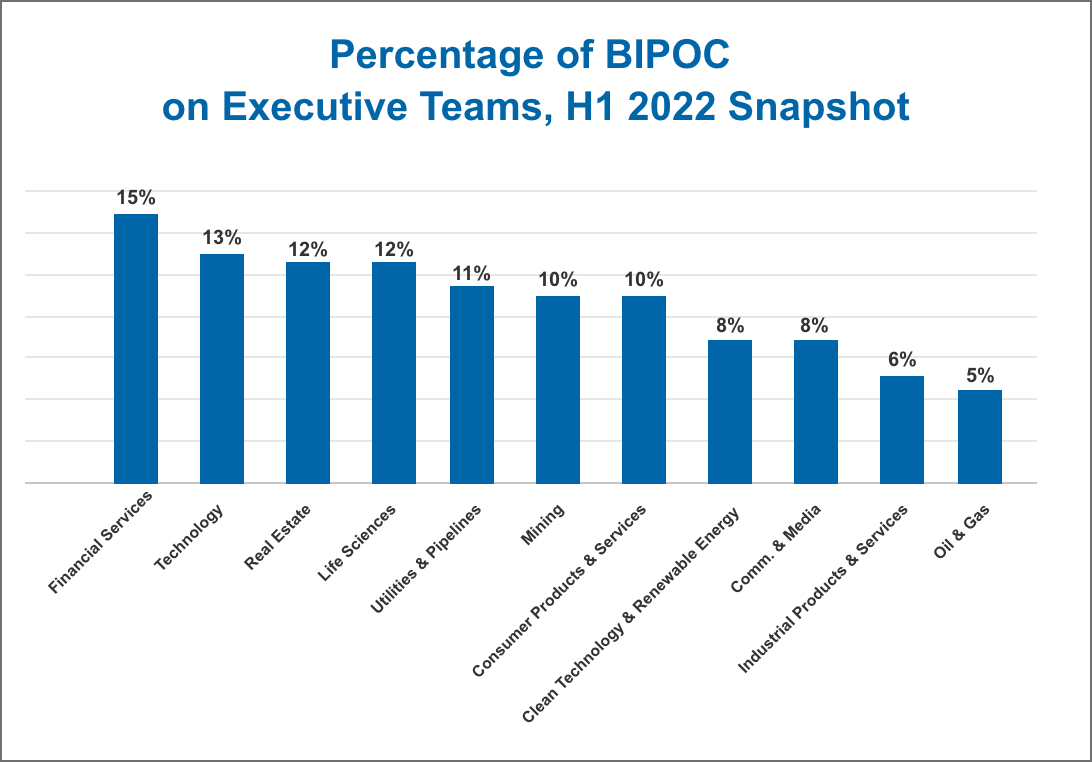

DUCA’s Board recognizes that diversity is important in ensuring its Directors possess the qualities, attributes, skills, education and experience required to effectively steward and oversee the strategic direction and management of DUCA. The Board recognizes the benefits of diversity, equity and inclusion toward attracting high-calibre Directors and maintaining a high functioning Board. Diversity, equity and inclusion enable diversity of thought, as such the Board considers diversity as an important factor in the optimum composition of the Board and its Committees.

Source: https://www.tsx.com/company-services/learning-academy/esg-101?id=635

DUCA’s purpose is to help People, Businesses and Communities Do more, Be more and Achieve more. Underpinning this purpose is the philosophy and belief that cooperative banking can be a powerful force for social good. This means our approach to ESG is informed by and integral to DUCA’s purpose and mission as a Credit Union. Our focus is also shaped by the priorities of the social and environmental landscape in which we operate including climate change, matters of diversity, equity and inclusion and the financial well-being of the Communities we serve. Going forward DUCA will progressively build on our ESG strengths through further refinement and amplification of goals, initiatives and measurements and a governance framework that continues to evolve and support DUCA’s environmental and social impact.

DUCA has a wholly owned subsidiary – Continental Currency Exchange Ltd. The Board provides oversight to this subsidiary at an enterprise level in accordance with DUCA’s Enterprise Risk Management policy requirements for subsidiary governance which comply with the FSRA Sound Business and Financial Practices Rule. DUCA’s subsidiary governance policy and framework enables the Board’s oversight through defined procedures and practices along with mechanisms for informing the Board of subsidiary level risks, compliance and governance matters as well as reporting on the subsidiary’s business and financial performance.

DUCA’s Board of Director remuneration is in accordance with its Member approved bylaws and Director Compensation and Expenses policy which adheres to FSRA’s Sound Business and Financial Practices Rule. The Board’s philosophy and approach to Director remuneration recognizes the importance of sound corporate governance as a key ingredient to corporate success. As such it is important that DUCA’s remuneration for Directors is commensurate, fair and reasonable when compared to organizations of similar size, complexity and risk profile within the Credit Union Sector. Accordingly, DUCA’s Board of Directors are remunerated at approximately the 50th percentile of Director remuneration for comparable organizations, with due consideration given to the required skills, education, experience, and commitment given DUCA’s nature, size, complexity, operations, and risk profile. The Governance Committee of the Board reviews Components of Directors remuneration at least every three years.

The Human Resources and Compensation Committee (HRCC) of the Board governs and oversees the remuneration programs of the CEO, senior management, and employees of the Credit Union. The Board and the HRCC ensure that remuneration programs of the Credit Union adhere to the fair and reasonable remuneration requirements codified in FSRA’s Sound Business and Financial Practices Rule. DUCA applies its remuneration philosophy and approach recognizing that it is our people that power DUCA’s ability to fulfill its purpose and achieve its corporate aspirations. On this basis, and within the context of its governance and regulatory frameworks, DUCA’s remuneration programs for the CEO, senior management and all employees of the Credit Union are in accordance with the following principles:

Equity, fairness, and alignment with DUCA’s purpose

DUCA’s employee remuneration is aimed at

ensuring remuneration is commensurate, fair, and equitable for established roles within the organization

as defined by job scope, complexity, job demands, required qualifications and skills, and organizational

impact. We strive to appropriately pay for performance through the evaluation of person-by-person

performance level against annually established objectives. We seek to ensure all employees are

compensated in a fashion that aligns with DUCA’s business and social purpose and philosophy.

Market competitiveness

Employee remuneration is geared to attract and retain the talent necessary to

enable DUCA’s ongoing strategic success and to support sustainable talent development and

organization succession planning. Accordingly, DUCA’s employee remuneration takes into account

market pay for similar or equivalent roles at comparable organizations taken from the Credit Union and

financial services sectors.

Alignment to corporate goals and objectives

Remuneration frameworks are designed to support and

encourage strong performance and commitment to the Credit Union and incentivize activity that

achieves DUCA’s organizational goals, objectives and sound business and financial practices. Ultimately,

this alignment enables delivering the best possible outcomes for Members and our stakeholders.

Consistent with DUCA’s remuneration philosophy and approach, base salary takes into consideration market factors including pay competitiveness as well as factors such as complexity, required qualifications and skills, demands of the role and organizational impact. Salary is reviewed annually and adjusted as appropriate, with a comprehensive market-based review performed at least every three years.

DUCA’s variable compensation for the CEO and Senior Management comprises a short-term incentive plan (STIP) and long-term incentive plan (LTIP). Both plans are paid contingently upon the degree of achievement against Board approved business performance targets.

Short-term incentive plan (STIP)

DUCA’s STIP links compensation to the achievement of annual

performance objectives. The plan has two components:

- Personal performance based on an evaluation of delivery against annually established performance objectives at the individual level.

- Business performance, which is based on specific, board approved business performance targets linked to DUCA’s Annual Operating Plan (AOP).

The level of personal and business performance in a fiscal year relative to personal objectives and business performance targets determines the total amount of STIP paid. An illustration of the STIP payment formula for eligible employees is as follows: STIP = 1. bonus eligible earnings x 2. target bonus % based on job grade x 3. business performance result (ranging from a minimum of 0% to a maximum of 125%) x 4. personal performance result tied to achievement of individual objectives (ranging from a minimum of 0% to a maximum of 150%). The STIP is applicable to all eligible employees at DUCA. STIP payable for the CEO and oversight roles of Chief Risk Officer and Chief Financial Officer, is subject to an additional regulatory compliance factor which ranges from a min of 0% to a max of 100%.

The annually approved business performance target component of the STIP covers four dimensions of business performance: profitability, Member satisfaction, business diversification, and business growth.

Long-term incentive plan (LTIP)

DUCA’s LTIP is established and approved by the Board annually and

links compensation of the CEO and eligible members of senior management to the achievement of

longer-term strategic objectives. LTIP is paid at the end of a three-year performance period contingent

upon the achievement of three-year forward looking business performance outcomes relative to Board

approved performance targets as per DUCA’s three-year strategic plan. The LTIP is based upon a target

percentage of base salary for each of the CEO and eligible members of senior management determined

by job grade. An illustration of the LTIP payment formula is as follows: LTIP payable at the end of a three-

year performance cycle = 1. Base salary x 2. LTIP target award for a specific job grade x 3. Business

performance outcomes relative to three-year forward looking business performance targets (ranging

from a min of 0% to a max of 125%).

The annually approved, three-year forward looking LTIP business performance targets cover dimensions of business performance such as: cumulative profitability, assets under management (AUM), and capital ratio at the end of a performance cycle.

Proportion of CEO remuneration at-risk

The combination of CEO base salary, LTIP and STIP which are

contingent upon meeting performance objectives, results in approximately 50% of the CEO’s total

remuneration being “at-risk”.

Retirement benefits

A defined contribution pension plan is available for all eligible employees at DUCA.

The degree of employer contribution and/or employer matching is determined based on job grade and

applicable base salary. DUCA contributes 10% of base salary towards the CEO’s retirement savings.

Benefits and perquisites

DUCA provides a market competitive benefits program to all eligible

employees covering health, dental, disability, life and accidental death and dismemberment insurance

as well as market competitive vacation leave, employee and family assistance and personal leaves. The

CEO, eligible members of senior management and vice presidents of DUCA also have access to additional

health benefits including an annual health assessment and year-round care for urgent medical attention.

The CEO is provided an allowance for expenses such as vehicle and commutation costs.

Details of the annual remuneration for the CEO and top remunerated members of senior management are available in the disclosures included in DUCA’s annual audited financial statements.

Audit Committee

Audit Committee

Credit Committee

Credit Committee

Nominations Committee

Nominations Committee

Governance Committee

Governance Committee

HR & Compensation Committee

HR & Compensation Committee

Risk Committee

Risk Committee